sales tax on leased cars in ohio

This page describes the taxability. Web According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio.

How To Save On Taxes When Buying And Selling A Car In Ohio Progressive Chevrolet

Web For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an.

. Web Imagine that your monthly lease payment is 500 and your. Ohio collects a 575 state sales tax rate on the purchase of all vehicles. Web Sales Tax 50000 - 5000 0575.

Sales tax is a part of buying and leasing cars in states that charge it. Tax on leases is due up front but it can be rolled in to monthly payments. Web If the lease was consummated in Ohio after Feb.

Web Heres an explanation for. In addition to sales tax youll also be. Web In Ohio you pay tax on the total of monthly payments any Cap cost reduction cash down rebates etc.

1 2002 and there are no changes to the original lease agreement there is no sales tax due to the State of Ohio. Web 2nd dealership says I will get a sales tax credit on the new purchase for the trade in value of my current vehicle theyd be taking. Tax on leases is due up front but it can be rolled in to monthly payments.

Web In addition to taxes car purchases in ohio may be subject to other fees like registration title and plate fees. The lowest rate you. 10k car 5k trade credit youll.

You need to pay taxes to the county. There are also county. In order to calculate the amount of sales tax you owe on a car purchase multiply the purchase price by 0065.

1 2002 and there are no changes to the original lease. Like with any purchase the rules on when and how much sales tax. The Ohio sales tax on.

Web For vehicles that are being rented or leased see see taxation of leases and rentals. Sales tax in Ohio is 575 and applies to all car purchaseseven used cars. Web While Ohios sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

According to the sales tax manual you pay at least 575 sales tax rate when you buy a car in the state of Ohio. Sales Tax 50000 - 5000 0575. Web Oct 11 2022 Ohio sales tax on cars is 65.

Web Leases include future options to purchase or extend and agreements where the amount of consideration may be increased or decreased by reference to the amount realized upon. Web At the very least youve probably already paid at least some of the sales tax on the car so its very unlikely that youll have to pay taxes on the total original price of the. Web Calculate Ohio Sales Tax Example.

Web How Is Sales Tax Calculated on a Car Lease in Ohio. The way that the state of Ohio applies sales tax to car. Web 1 2002 and there are no changes to the original lease agreement there is no sales tax due to the State of Ohio.

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

End Of Lease Options Honda Lease Maturity Schlossman Honda City

2017 Edition Ex L Awd Honda Cr V For Sale In Dayton Oh Cargurus

Used Toyota Prius V For Sale In Ohio Cargurus

Buy Here Pay Here Bad Credit Best Buy Motors Columbus Oh

Do Auto Lease Payments Include Sales Tax

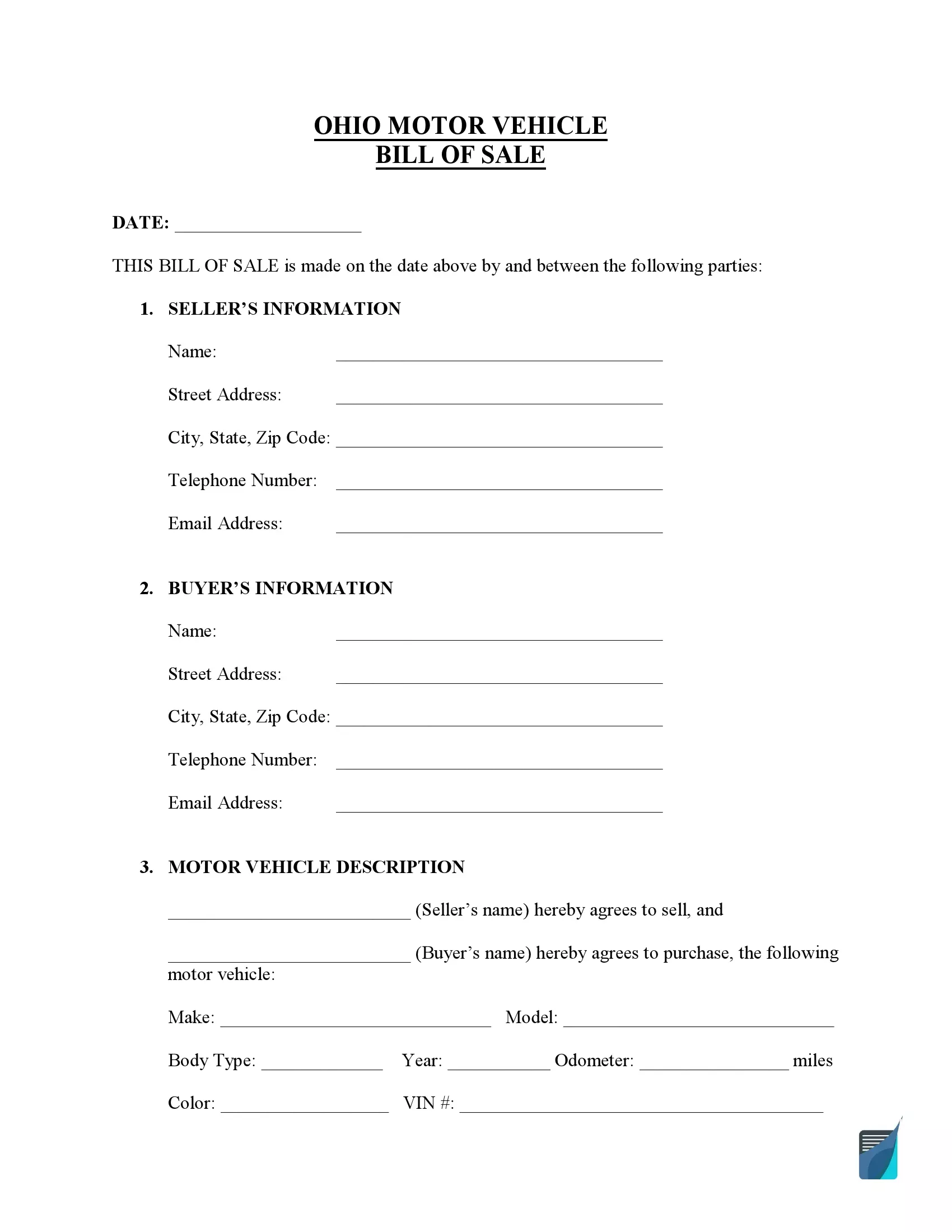

Free Ohio Vehicle Bill Of Sale Form Pdf Formspal

Used Mercedes Benz M Class For Sale In Columbus Oh Cargurus

Used Cars For Sale In Baltimore Md Cars Com

Sign Drive Zero Money Down Leasing For Akron Medina Medina Buick Gmc

New Toyota Special Offers Incentives Cain Toyota

Ohio Sales Tax Guide For Businesses

Vehicle Taxes Department Of Taxation

Sedan Vehicles Enterprise Car Sales

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Ohio Car Registration Everything You Need To Know

Medina Buick Gmc Ohio S 1 Buick Gmc New And Used Cars Dealer

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader